Aug 27, 2024

The UK freelance market has seen a remarkable surge, as evidenced by the most recent UK census, which revealed that 4.7 million people are self-employed, constituting nearly 10% of UK residents aged 16+.

This expansion is further evidenced by a study showing that 80% of companies and agencies now rely on freelancers, with as many as 78% more likely to hire freelancers than employees.

This shift in the workforce landscape brings with it new responsibilities, particularly the need to understand IR35, a crucial piece of UK legislation.

For the uninitiated, IR35, also known as off-payroll working, was introduced in the UK in April 2000 to ensure that freelancers (sometimes referred to as contractors) pay income tax and national insurance the same way a salaried employee would.

In other words, the legislation aims to prevent contractors from working as employees in disguise, i.e., ones who don't meet the UK’s HMRC definition of self-employed.

As such, employers and agencies must correctly classify such workers to comply with their legal and financial responsibilities.

With that said, let's discuss IR35 in more detail…

Risks of Non-compliance

Non-compliance or misinterpretation of IR35 rules can lead to various legal risks and reputational consequences, underscoring the importance of understanding and adhering to these rules.

Let's take a look at the potential outcomes:

HMRC (His Majesty’s Revenue and Customs) has the right to investigate the IR35 statuses of contracts going back six years. If HMRC finds that a contractor is, in fact, an employee and has been misclassified, you will have to have to pay back taxes.

If HMRC finds that a freelancer or company/agency was careless about their employment status but didn't know it was inaccurate, a penalty of 30% of unpaid tax is imposed. This penalty rises to 70% if the entity knew they were within IR35 and chose not to act and to 100% if the contractor actively concealed their IR35 status.

One notable example of an organization that's broken these rules is Defra (Department for Environment, Food and Rural Affairs), which paid HMRC £86.5 million in back taxes in 2022 for off-payroll errors.

Another UK Government department that made the same error is the Home Office, which, in 2021, paid HMRC £33.5 million in back taxes.

Aside from the legal ramifications, non-compliance with IR35 can lead to reputational damage. HMRC has the authority to publish the details of companies that have incorrectly classified workers, potentially tarnishing their reputation. This could deter freelancers and employees from working with you and discourage customers from purchasing from your brand.

Despite the complexities of IR35, there are solutions available to ensure compliance. Let’s explore these solutions in detail:

How to Ensure Compliance With IR35

Several criteria are used by the UK’s HMRC to determine whether a freelancer falls inside or outside of IR35.

But it’s also important to know that the rules differ depending on the type of business a freelancer works for. For example, if they work for a small business, the contractor is responsible for determining their own status. In contrast, if a freelancer works for mid-sized or large-sized companies, the onus is on the enterprise to assess the worker’s status.

It's well-documented that the criteria and regulations are confusing to freelancers and organizations alike, with some freelancers fearing they may be classified incorrectly regardless of their status.

One study found that 42.8% of freelancers believe they had been subject to blanket IR35 determinations or placed inside IR35, irrespective of their real employment status. In addition, 67.6% stated they want the IR35 reforms reversed.

With so much uncertainty surrounding worker classification, it’s essential to have strategies in place to assess contracts and work arrangements to safeguard against accidental misclassification.

One such service you can use is HMRC's online diagnostic tool, the Check Employment Status for Tax tool (CESA). Based on the information you input, this tool can determine whether the worker is:

Employed for tax purposes

Self-employed for tax purposes

Off-payroll working (IR35) rules apply

Off-payroll working (IR35) rules do not apply

However, it's worth noting that even if you use this tool, HMRC still reserves the right to investigate any contractor/client relationship.

As you may have already guessed, the tool will ask a series of multiple-choice questions. Then, upon completion, the tool gives you either an “inside” or “outside” IR35 classification.

In the EU, each member state has its own set of rules regarding worker classification. For example, in Germany, their tax office (Finanzamt) evaluates professions on a case-by-case basis - and certain professions, such as lawyers, journalists, and accountants, are classified as freelancers.

Elsewhere, in the US, there’s the W-9 form. If you're an employer, you'll need freelancers to fill out this form to receive the necessary taxpayer information to identify a 1099 independent contractor.

More broadly, businesses that want to adopt a manual and old-school approach to IR35 classification need to:

Ensure they conduct thorough background checks on every contractor to ensure compliance.

Hire tax and legal professionals to help evaluate workers for IR35-compliance.

Keep detailed records of each individual to ensure there’s no missing information when determining the IR35 status of a work contract. For example, keep records of all communications between the company and the freelancer, any contractual terms, etc, that can evidence a person is outside IR35.

Ensure all payment arrangements are transparent and invoices are issued for each payment.

Have a robust compliance system in place - this should include leveraging worker classification tools and conducting regular audits.

IR35 Classification the Easy Way

Rather than adopting a manual approach (that isn't necessarily reliable because it's prone to human error, misunderstanding, and misinterpretation), fortunately, there's a more straightforward way.

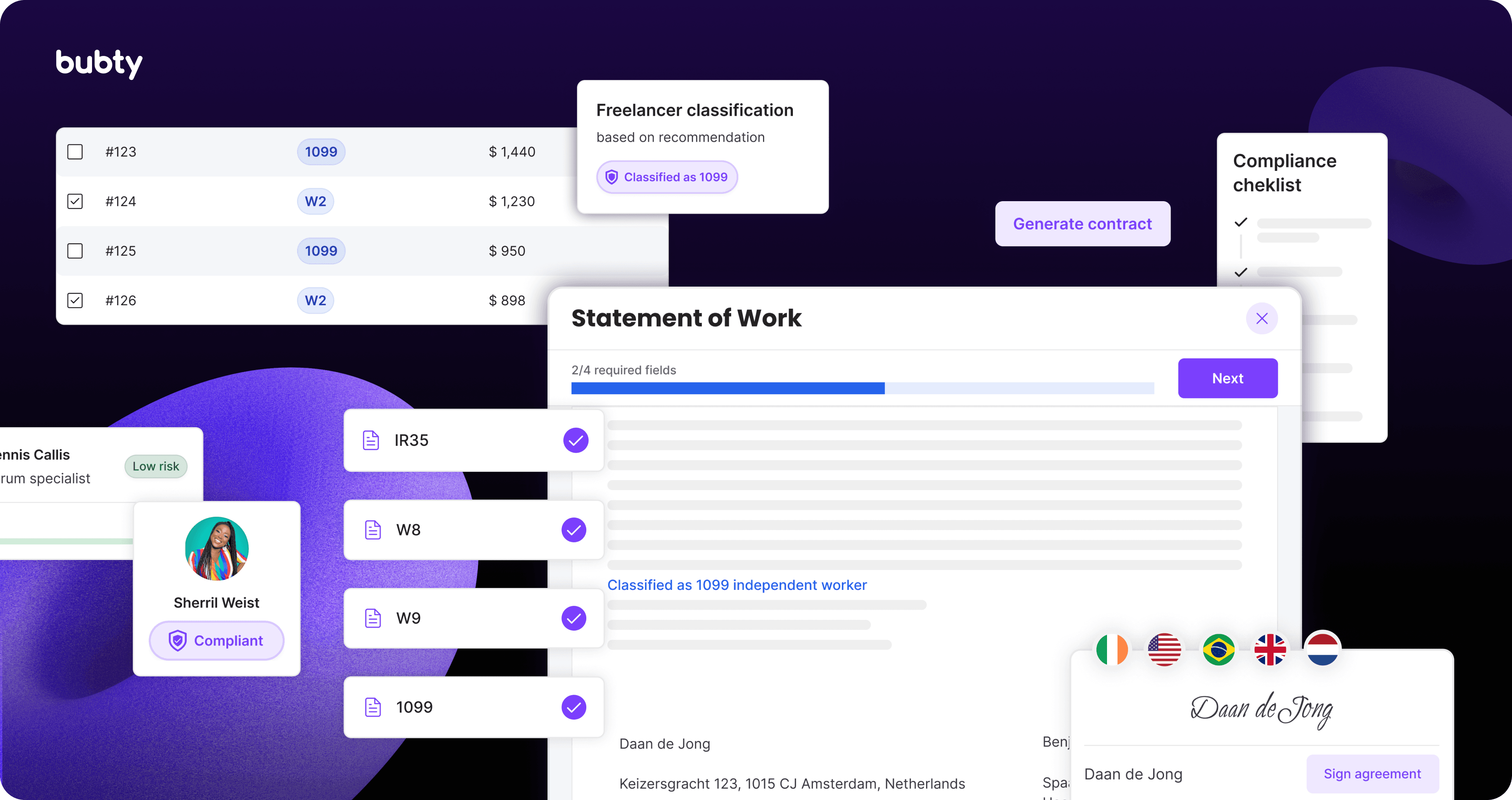

Adopting a robust freelancer management platform like Bubty presents a secure and consistent way to store your freelancer's legal documentation and work agreements.

This entire process can be customized so that all of the necessary information for IR35 classification is automatically requested and obtained during your onboarding process, including any forms that need signing. This ensures all essential paperwork is completed from the start. The result is a standardized and consistent compliance procedure that's audit-proof.

At this point, it's worth highlighting that Bubty offers several noteworthy features to help with IR35 classification, including:

Global freelancer classification with Bubty Classified: Bubty conducts automated assessments to determine a freelancer’s IR35 status efficiently and transparently. This is because Bubty Classified offers instant freelancer classification for each country, including the UK. Elsewhere, in the US, this is drilled down further to meet local and state requirements and, in the EU, to meet each member state’s laws.

Misclassification indemnity: Bubty offers coverage for legal misclassification risks and costs, giving you peace of mind and protection against misclassification. We also provide freelancers global insurance coverage to protect them against misclassification.

Compliance tracking: We conduct regular compliance audits, which Bubty says will help you achieve and maintain a 98% compliance rate.

Automated freelancer contracts: Bubty’s automated platform inserts personalized classification and tax information into each freelancer contract. This, in turn, removes any manual errors.

Storage: Once all compliance documents are signed, Bubty stores them in its secure system. Bubty complies with all relevant EU (including UK) and US privacy laws, so all information remains safe.

IR35: Our Final Thoughts

Freelancer classification under IR35 can be challenging and time-consuming if you’re doing it in a reactive and paper-driven way. However, it doesn’t have to be the case if you’re fully equipped with a robust freelance management software like Bubty.

Want to learn more? Download our free 'Freelance Management Blueprint', where you'll find additional resources and information to help you navigate the complex waters of IR35, worker classification, and compliance. Enjoy!